In the fast-paced world of forex trading, where currencies fluctuate by the second, moving average indicator serve as your compass, guiding you through market turbulence toward profitable opportunities. Whether you’re a novice trader taking your first steps or an experienced professional looking to refine your strategy, understanding how to effectively use moving averages can be the difference between consistent profits and costly mistakes. This comprehensive guide will walk you through everything you need to know about moving average indicator, from the fundamentals to advanced trading strategies that can transform your forex trading results.

Understanding Moving average indicator: Your Foundation for Success

A moving average indicator is essentially a trend-following tool that calculates the average price of a currency pair over a specific number of periods, creating a smooth line that filters out short-term price fluctuations. Think of it as a mathematical smoothing technique that helps you see the forest for the trees in forex trading. When you apply a moving average to your chart, you’re creating a dynamic line that moves with the market, constantly updating to reflect the most recent price action while maintaining a broader perspective on the underlying trend.

The beauty of moving average indicator lies in their simplicity and effectiveness. By averaging out price movements over time, these indicators help traders identify the overall direction of a currency pair without getting distracted by temporary spikes or dips that are common in forex markets. For instance, while the EUR/USD might experience dozens of minor fluctuations throughout a trading day, a 20-period moving average will show you the general direction these movements are taking, making it easier to align your trades with the prevailing trend.

Moving averages work on any timeframe, from one-minute charts for scalpers to monthly charts for long-term position traders. This flexibility makes them invaluable tools for forex traders with different trading styles and time horizons. The key is understanding that moving averages are lagging indicators, meaning they reflect what has already happened rather than predicting future price movements. However, this characteristic doesn’t diminish their value; instead, it provides confirmation of trend changes and helps traders avoid false signals that can plague other technical indicators.

The Three Pillars: Types of Moving average indicator

Simple Moving Average: The Time-Tested Foundation

The Simple Moving Average, commonly known as SMA, represents the most straightforward approach to calculating moving averages. This indicator simply adds up the closing prices of a currency pair over a specified number of periods and divides by that number. For example, a 10-day SMA of EUR/USD would add up the closing prices from the last 10 trading days and divide by 10, creating a single data point that gets updated each day.

The SMA’s strength lies in its equal treatment of all data points within its calculation period. Every closing price carries the same weight, whether it occurred yesterday or ten days ago. This characteristic makes SMAs particularly effective for identifying long-term trends and filtering out short-term market noise. Many institutional traders and fund managers rely heavily on longer-period SMAs, such as the 200-day SMA, to determine the overall health and direction of major currency pairs.

However, the democratic approach of SMAs also presents a limitation in fast-moving forex markets. Because older price data carries the same weight as recent data, SMAs can be slow to respond to sudden trend changes. This lag can result in delayed entry and exit signals, potentially causing traders to miss optimal trading opportunities or hold losing positions longer than necessary. Despite this drawback, SMAs remain incredibly popular among forex traders for their reliability and ease of interpretation.

Exponential Moving Average: The Responsive Alternative

The Exponential Moving Average, or EMA, addresses the primary weakness of SMAs by giving greater weight to more recent price data. Instead of treating all prices equally, the EMA applies a multiplier that decreases exponentially for older prices, making the indicator more responsive to current market conditions. This mathematical approach allows EMAs to react faster to price changes, providing earlier signals for trend reversals and continuations.

The calculation of an EMA involves a smoothing factor that determines how much weight recent prices receive compared to older ones. A 12-period EMA, for instance, will give significantly more importance to today’s closing price than to the price from 12 days ago, while still considering all data points in its calculation. This weighting system makes EMAs particularly valuable in volatile forex markets where quick reaction times can mean the difference between profit and loss.

Professional forex traders often prefer EMAs over SMAs when trading shorter timeframes or when dealing with highly volatile currency pairs like GBP/JPY or AUD/JPY. The faster response time of EMAs can help traders capture more of a price movement and exit positions before significant reversals occur. However, this sensitivity comes with a trade-off: EMAs are more prone to false signals during periods of sideways price action, requiring traders to use additional confirmation tools or filters to improve their accuracy.

Weighted Moving Average: The Precision Tool

The Weighted Moving Average, though less commonly used than SMAs and EMAs, offers a middle ground between the two more popular alternatives. WMAs assign linearly decreasing weights to older prices, with the most recent price receiving the highest weight and each subsequent older price receiving progressively less weight. This approach creates an indicator that’s more responsive than SMAs but less sensitive than EMAs.

In forex trading, WMAs can be particularly useful when you want more responsiveness than an SMA provides but don’t want the potential whipsaws that EMAs might generate in choppy market conditions. The linear weighting system of WMAs provides a balanced approach to trend identification, making them suitable for medium-term trading strategies where both trend following and timely signals are important.

Mastering Moving Average Trading Strategies in Forex

Trend Identification: Your Market Compass

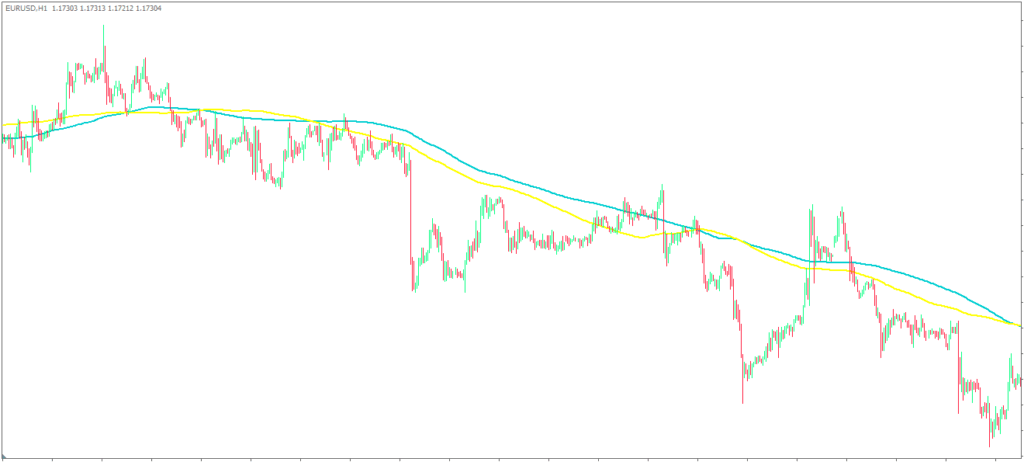

The primary function of moving average indicator in forex trading is trend identification, and mastering this skill is crucial for long-term success. When the price of a currency pair consistently trades above its moving average, it signals an uptrend, suggesting that buyers are in control and further upward movement is likely. Conversely, when price action remains below the moving average, it indicates a downtrend, with sellers dominating the market dynamics.

The relationship between price and moving averages becomes even more powerful when you consider the slope of the moving average itself. A rising moving average combined with price action above the line creates a strong bullish signal, while a declining moving average with price below creates a bearish scenario. This dual confirmation helps forex traders avoid false signals and increases the probability of successful trades.

For practical application, consider the GBP/USD currency pair during a strong uptrend. When the price consistently holds above a 50-period EMA that’s sloping upward, it provides compelling evidence that the upward momentum is likely to continue. Traders can use pullbacks toward the moving average as potential buying opportunities, treating the EMA as dynamic support. This approach has proven particularly effective in trending forex markets, where currencies can maintain directional bias for extended periods.

Support and Resistance: Dynamic Market Levels

Moving averages don’t just identify trends; they also act as dynamic support and resistance levels that adapt to changing market conditions. Unlike static horizontal lines drawn at specific price levels, moving averages constantly adjust to reflect current market sentiment, providing more relevant and actionable trading levels.

During uptrends, moving averages often act as support levels where buyers step in to push prices higher. The 20-period and 50-period EMAs are particularly popular among forex day traders for this purpose. When EUR/USD is in an uptrend and pulls back to test its 20-period EMA, observant traders watch for signs of buying interest at this dynamic support level. If the currency pair bounces from the EMA with strong volume, it often signals continuation of the upward trend.

In downtrends, the same moving averages that provided support during upward moves now become resistance levels that cap rallies. Professional forex traders understand this role reversal and use it to their advantage by looking for shorting opportunities when price approaches major moving averages from below during downtrends. The psychological aspect of these levels cannot be overstated, as thousands of traders worldwide watch the same moving averages, creating self-fulfilling prophecies when key levels are tested.

Moving Average Crossover Systems: Timing Your Trades

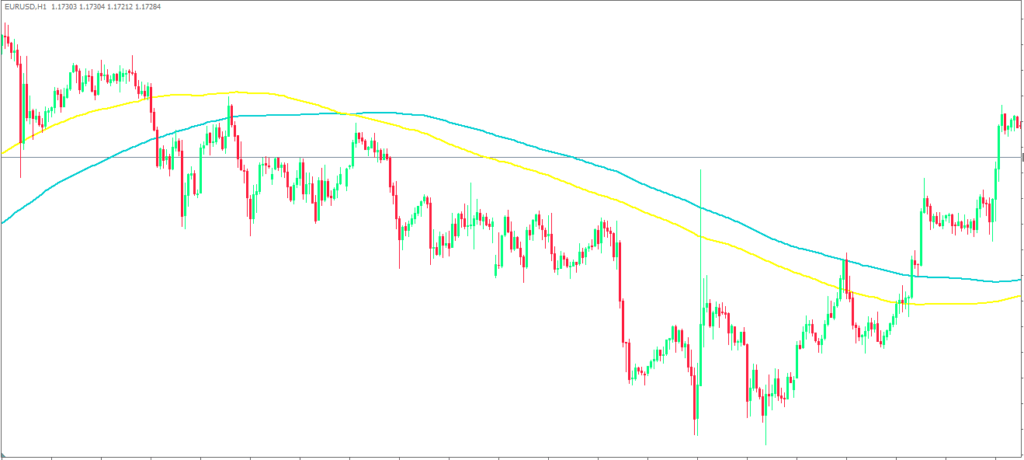

One of the most popular and effective applications of moving average indicator involves crossover systems, where two or more moving averages of different periods interact to generate trading signals. The golden cross, perhaps the most famous bullish signal in technical analysis, occurs when a shorter-period moving average crosses above a longer-period moving average, suggesting the beginning of an upward trend.

The classic golden cross setup uses the 50-day and 200-day moving averages, but forex traders often adapt this concept to shorter timeframes using combinations like the 12-period and 26-period EMAs. When the faster EMA crosses above the slower one while both averages are rising, it creates a powerful bullish signal that often coincides with significant upward price movements. The opposite scenario, known as the death cross, occurs when the faster moving average crosses below the slower one, generating bearish signals.

Multiple moving average systems take this concept further by incorporating three or more averages to filter signals and improve accuracy. A popular three-EMA system might use 8, 21, and 55-period averages, with trades only taken when all three averages are aligned in the same direction and price action confirms the trend. This approach helps eliminate many false signals that occur during sideways market conditions, though it may also result in later entry points.

Entry and Exit Strategies: Precision Timing

Successful forex trading with moving average indicator requires well-defined entry and exit strategies that maximize profit potential while managing risk effectively. For trend-following entries, many traders wait for price to pull back to a key moving average in a trending market, then enter when price begins to move away from the average in the direction of the trend.

A practical example might involve trading USD/CAD during a downtrend where the currency pair has been consistently trading below its 50-period EMA. When price rallies back toward the EMA but fails to break above it, traders can enter short positions with stops placed just above the moving average. This approach provides a clear risk management framework while offering favorable risk-to-reward ratios.

Exit strategies using moving averages can be equally systematic. Profit-taking might occur when price reaches a predetermined distance from the moving average, or when a faster moving average crosses back through a slower one, signaling potential trend exhaustion. Some traders prefer to trail their stops using moving averages, allowing winning trades to run while protecting profits as trends mature.

Optimizing Moving Average Settings for Different Trading Styles

The effectiveness of moving average indicator largely depends on selecting appropriate settings that match your trading timeframe and style. Short-term forex traders, including scalpers and day traders, typically favor faster moving averages that respond quickly to price changes. Common settings for active traders include 5, 10, and 20-period averages, which provide timely signals but may generate more false signals during choppy market conditions.

Medium-term traders often find success with the classic combination of 20, 50, and 100-period moving averages. These settings strike a balance between responsiveness and reliability, making them suitable for swing trading strategies that hold positions for several days to weeks. The 50-period moving average, in particular, has gained popularity among forex traders for its ability to identify intermediate-term trends while filtering out much of the short-term noise.

Long-term position traders and investors typically rely on slower moving averages such as the 100, 150, and 200-period settings. The 200-day moving average holds special significance in financial markets, as it’s widely watched by institutional investors and often acts as a major support or resistance level for currency pairs. When major currencies like EUR/USD or GBP/USD trade above their 200-day moving average, it’s generally considered a sign of long-term bullish sentiment.

Market conditions also influence optimal moving average settings. During trending markets, slightly faster settings can help capture more of the price movement, while ranging or volatile markets may require slower settings to avoid excessive false signals. Experienced traders often adjust their moving average periods based on recent market volatility and the specific characteristics of the currency pairs they’re trading.

The Reality Check: Advantages and Limitations

Moving average indicator offer numerous advantages that make them indispensable tools for forex traders. Their simplicity makes them accessible to beginners while their effectiveness keeps them relevant for professional traders. Moving averages excel at identifying trends, providing clear visual representations of market direction that can be understood at a glance. They also serve multiple functions within a single indicator, acting as trend filters, support and resistance levels, and signal generators.

The mathematical foundation of moving averages provides objective, emotion-free analysis that can help traders avoid the psychological pitfalls that plague discretionary trading approaches. When a currency pair is trading above its 50-period EMA that’s sloping upward, the bullish bias is clear and measurable, removing guesswork from trend identification. This objectivity is particularly valuable in forex markets, where emotional decision-making can quickly lead to significant losses.

However, moving average indicator also have important limitations that traders must understand and account for. As lagging indicators, they will always be behind price action, meaning they confirm trends after they’ve already begun rather than predicting them in advance. This lag can result in missed opportunities at the very beginning of trends and delayed exit signals as trends end.

Moving averages also struggle in sideways or choppy markets, generating frequent false signals as prices whipsaw above and below the average. During these conditions, traders may find themselves stopped out of multiple positions before a clear trend emerges. Additionally, the smooth nature of moving averages can sometimes mask important price action details, such as support and resistance levels that might be visible on raw price charts but obscured by the averaging calculation.

Comparing Moving Averages to Other Technical Indicators

While moving average indicator are powerful tools, they work best when combined with other forms of technical analysis rather than used in isolation. Momentum indicators like the Relative Strength Index (RSI) or Stochastic Oscillator can provide valuable confirmation for moving average signals, helping traders identify overbought or oversold conditions that might affect the reliability of trend signals.

The Moving Average Convergence Divergence (MACD) indicator actually incorporates moving averages in its calculation but presents the information differently, focusing on the convergence and divergence of two EMAs. Many forex traders use MACD alongside traditional moving averages to gain additional insight into trend strength and potential reversal points.

Volume indicators, while less commonly available in spot forex markets, can provide important confirmation for moving average signals in currency futures or when available through certain brokers. High volume accompanying a moving average breakout or crossover signal generally increases the probability of a successful trade.

Combining moving averages with price action analysis creates a particularly powerful approach to forex trading. Chart patterns, candlestick formations, and key support and resistance levels can all work together with moving average signals to create high-probability trading opportunities. The key is finding the right balance between different analytical approaches without overcomplicating the decision-making process.

Your Path Forward: Implementing Moving Averages Successfully

Moving average indicator have earned their place as essential tools in every forex trader’s arsenal through decades of proven effectiveness and reliability. From simple trend identification to sophisticated trading systems, these versatile indicators offer solutions for traders at every skill level and with every trading style. The key to success lies not in finding the perfect moving average setting or system, but in understanding how these tools work and adapting them to your specific trading goals and market conditions.

Remember that moving averages are just one piece of the trading puzzle. While they provide valuable insight into market trends and potential trading opportunities, they work best when combined with sound risk management, proper position sizing, and a thorough understanding of fundamental factors that drive currency markets. The most successful forex traders use moving averages as part of a comprehensive trading approach rather than relying on them exclusively.

As you begin incorporating moving average indicator into your forex trading strategy, start simple and gradually build complexity as your experience and confidence grow. Begin with basic trend identification using a single moving average, then progress to crossover systems and multiple average approaches as you become more comfortable with their behavior in different market conditions.

The forex market offers unlimited opportunities for those who approach it with the right tools and mindset. Moving average indicator provide a solid foundation for navigating these opportunities successfully. Take the time to practice with different settings and timeframes, and don’t be afraid to adapt your approach as you learn more about how these powerful indicators behave in various market environments.

Frequently Asked Questions About Moving average indicator

What’s the best moving average setting for forex day trading?

For forex day trading, most successful traders use combinations of 8, 21, and 55-period EMAs, or the classic 12 and 26-period setup. These shorter periods provide timely signals while filtering out excessive noise. However, the “best” setting depends on the currency pair’s volatility and your risk tolerance. Major pairs like EUR/USD often work well with 20 and 50-period EMAs, while more volatile pairs might require longer periods to reduce false signals.

Should I use Simple Moving Averages or Exponential Moving Averages for forex trading?

Exponential Moving Averages are generally preferred for forex trading because they react faster to price changes, which is crucial in the fast-moving currency markets. EMAs give more weight to recent price action, making them more responsive to trend changes. However, SMAs can be useful for longer-term analysis and are less prone to false signals during choppy market conditions. Many traders use EMAs for entries and SMAs for overall trend confirmation.

How do I avoid false signals when using moving average crossovers?

To reduce false signals in moving average crossover systems, use multiple confirmation techniques: wait for the crossover to occur with both averages sloping in the direction of the signal, require price to close above or below both averages, and consider using longer-period averages during volatile market conditions. Additionally, avoid trading crossover signals during major news events or in clearly sideways markets where whipsaws are common.

Can moving averages work in ranging forex markets?

Moving averages are less effective in ranging markets and can generate numerous false signals. During these conditions, consider using moving averages as dynamic support and resistance levels rather than trend-following signals. You might also increase the periods of your moving averages to reduce sensitivity, or combine them with oscillators like RSI to identify overbought and oversold conditions within the range.

What’s the significance of the 200-period moving average in forex trading?

The 200-period moving average is widely watched by institutional traders and is considered a major indicator of long-term trend health. When a currency pair trades above its 200-period MA with the average sloping upward, it indicates a strong long-term uptrend. Conversely, trading below a declining 200-period MA suggests a long-term downtrend. This average often acts as significant support or resistance and can influence market sentiment when tested by major currency pairs.