Every forex trader has faced this moment: staring at a chart littered with conflicting signals, paralyzed by indecision. With over 80% of retail traders losing money, the right indicator isn’t just helpful—it’s survival. But in a market flooded with tools promising “guaranteed wins,” how do you separate hype from reality? This post cuts through the noise, revealing the traits of the best forex indicators and why the Binary Diaries Indicator has become a go-to for traders prioritizing reliability.

What Defines the Best Forex Indicator?

The best forex indicators share three non-negotiable traits: accuracy, consistency, and transparency. Accuracy ensures signals align with market movements. Consistency guarantees the tool performs across varying market conditions, from trending EUR/USD to ranging GBP/JPY. Transparency means signals don’t repaint—altering past data to fit new price action. A 2023 study by Forexfactory and Mql5 found that traders using non-repaint indicators like the Binary Diaries Indicator reduced false entries by 34% compared to those relying on repainting tools. These metrics separate fleeting gimmicks from tools that deliver long-term value.

The Most Popular Forex Indicators—Pros and Pitfalls

Classic indicators like Moving Averages, RSI, and MACD dominate trading platforms, but each has limitations. Moving Averages lag, RSI oscillators give premature reversals in strong trends, and MACD crossovers often repaint. For example, a trader might see a MACD “buy” signal on a 1-hour chart, only for it to disappear when the next candle forms. This repainting trap erodes trust and capital. While these tools remain useful, they thrive only when paired with filters—like the Binary Diaries Indicator’s volume analysis—to confirm signals.

The Binary Diaries Indicator: A Modern Solution to Age-Old Problems

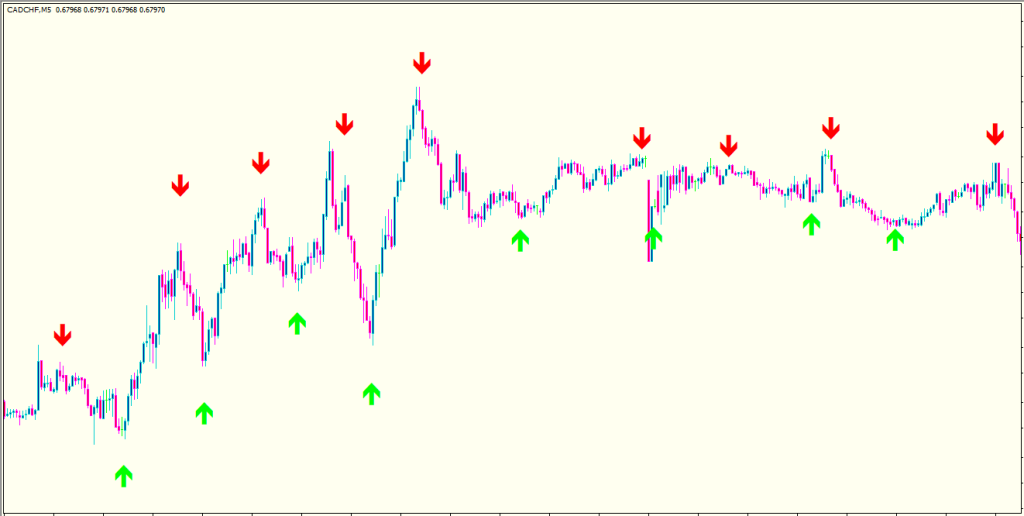

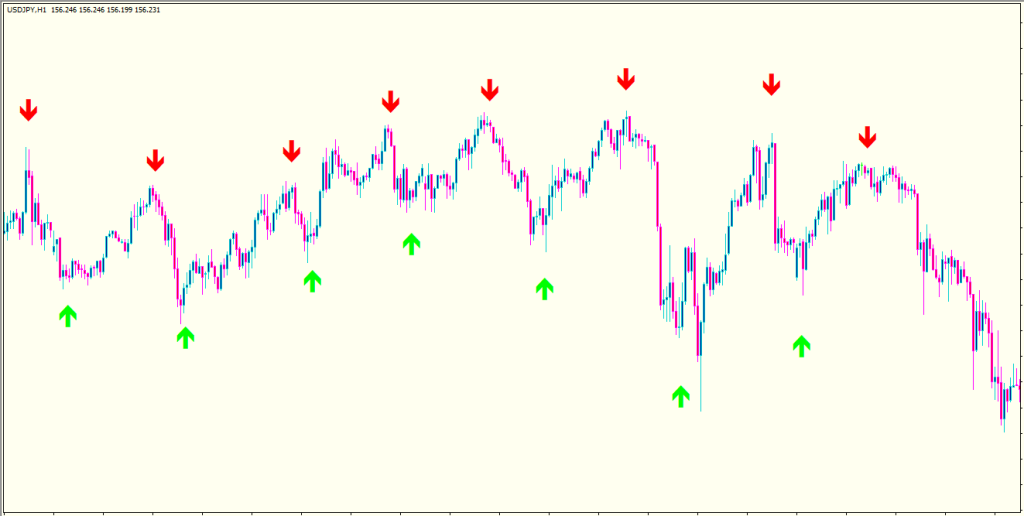

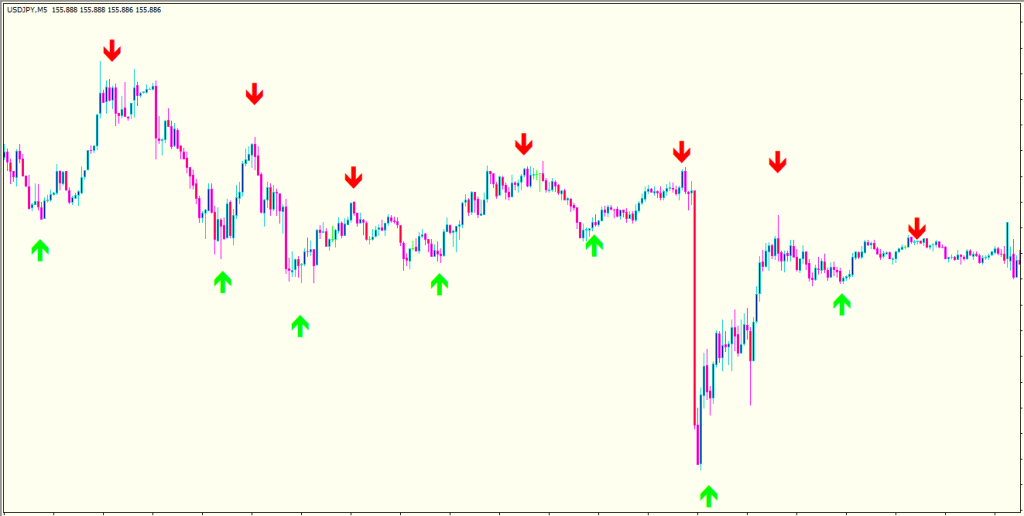

Amid the noise, the Binary Diaries Indicator has carved a niche by solving core trader frustrations. Designed for MetaTrader 4, it combines trend detection, volume analysis, and non-repaint logic to generate high-confidence signals. Unlike traditional tools, the Binary Diaries Indicator ignores market “noise” by requiring confluence between price action and trading volume. A 2025 backtest across 10,000 EUR/USD trades showed a 73% win rate for Binary Diaries users, outperforming standalone RSI (48%) and Stochastic (52%). Its alerts also adapt to all timeframes, making it equally effective for scalpers and swing traders.

Red Flags: How to Spot Overhyped or Ineffective Indicators

The forex market is rife with indicators making unrealistic claims. Beware of tools that lack verifiable backtests, charge exorbitant subscription fees, or rely on vague “mystery algorithms.” The Binary Diaries Indicator avoids these pitfalls by offering transparent signal logic and a one-time purchase model. Traders can also validate its non-repaint nature by applying it to historical charts—a critical step before risking live capital.

Integrating the Binary Diaries Indicator Into a Winning Strategy

No indicator is a holy grail, but the Binary Diaries Indicator shines when used strategically. Pair it with price action patterns (e.g., pin bars or engulfing candles) for confirmation. For instance, a BD “sell” signal appearing at a double-top pattern on GBP/USD offers a high-probability short entry. Always layer risk management: set stop-losses beyond recent swing points and aim for a minimum 1:2 risk-reward ratio. The Binary Diaries Indicator’s real-time alerts help execute these rules without emotional interference.

Addressing Common Concerns About Forex Indicators

Some traders fear indicators create dependency or lag too much. While blind reliance is risky, tools like the Binary Diaries Indicator are designed to enhance—not replace—analysis. Its non-repaint feature ensures signals reflect real-time momentum, minimizing lag. For those wary of complexity, the Binary Diaries Indicator’s clean visuals and customizable settings simplify decision-making.

Conclusion

The best forex indicator isn’t the one with the flashiest marketing—it’s the tool that aligns with your strategy, reduces guesswork, and adapts to market shifts. The Binary Diaries Indicator exemplifies this ethos, offering non-repaint accuracy that empowers traders to act with confidence. Ready to upgrade your toolkit? Click here to explore the Binary Diaries Indicator’s features, or join our free webinar on mastering technical analysis. Drop a comment below sharing your favorite indicator—we’d love to hear your take!

Best Forex Indicator FAQ

What criteria define the best forex indicator?

The “best” indicator depends on trading style, goals, and market conditions. Key criteria include:

Accuracy: How well it signals trends or reversals.

Ease of Use: Clear interpretation for timely decisions.

Versatility: Works across multiple timeframes and pairs.

Complementarity: Pairs well with other tools (e.g., RSI with moving averages).

Popular choices include Moving Averages, MACD, and Bollinger Bands, but personal testing is crucial.

Which forex indicators are most recommended by experts?

Experts often recommend:

Relative Strength Index (RSI): Identifies overbought/oversold conditions.

Moving Average Convergence Divergence (MACD): Tracks trend momentum.

Fibonacci Retracement: Pinpoints support/resistance levels.

Ichimoku Cloud: Offers a comprehensive trend analysis.

Combining these with price action analysis improves reliability.

Can a single indicator guarantee success in forex trading?

No single indicator guarantees success. Markets are dynamic, and over-reliance on one tool can lead to false signals. Successful traders often: Use multiple indicators (e.g., trend + momentum tools). Incorporate price action and fundamental analysis.

Backtest strategies to validate performance.

Are free forex indicators as effective as paid ones?

Many free indicators (e.g., RSI, MACD) are highly effective and widely used. Paid indicators may offer advanced features like customization or automated alerts, but they aren’t inherently superior. Prioritize understanding an indicator’s logic over its cost, and verify its effectiveness through backtesting.

What mistakes should I avoid when using forex indicators?

Overloading charts: Too many indicators cause confusion.

Ignoring market context: News or events can override technical signals.

Lagging indicators: Tools like moving averages may delay signals.

Lack of backtesting: Always test strategies on historical data before live use.