A Binary Options trade calls for several decisions to be taken by the investor. Deciding on the Underlying Asset The first decision is choosing an asset. Based on which broker you decide on, you will have a selection of assets from different financial markets. Some Binary Options traders like to focus on one particular asset, or one market, while others trade several options simultaneously. One consideration as to what asset to trade has to do with the opening hours of the various world stock exchanges. Currencies are usably available for trade 24 hours a day. Most brokers offer four classes of assets: Commodities – e.g.: Gold, Silver, Wheat, Coffee, Oil, Sugar, and Platinum. Stocks – e.g.: City (US), Apple (US), Gazprom (Russia), BP (British Petroleum), Google (US), SberBank (Russia), Coca Cola(US). Forex (Currencies) – e.g.: GBP/USD, USD/JPY, USD/CAD, EUR/JPY, EUR/GBP, USD/TRY, USD/BRL Indices (Indexes): – e.g.: DOW (US), S&P 500 (US), NASDAQ (US), DAX (Germany), CAC (France), FTSE 100 (U.K).

Deciding on an Amount to Invest Binary options brokers allow for a low minimum so you can be flexible as to the amounts you can invest. The amounts you devote to trade should be dictated by your risk management plan (more on this when we talk about risk management later on).

Deciding on the Desired Time Frame Binary options are short term investment instruments by definition. The time frame available can run from one minute to a week, depending on the trading platform. So what time frame should you choose? The problem with selecting very small timeframes like one minute, or 5 minutes is that you could possibly experience a lot of “noise” which is a result of hedge funds activity, scalpers and automated trading. You could think that you observe an emerging trend only to realize that it was only a brief manipulated move and that the trend is over once you enter the market. Therefore I suggest you use at list a 15 minute time frame. This is small enough for you to capture the nice moves, but it’s big enough to eliminate the noise in the market and correctly displays the “true trends.” While preparing a trading strategy (we will cover this in a later chapter), it is best to experiment with various timeframes. A trading strategy that doesn’t work on a small timeframe might work on a larger timeframe and vice versa. Start developing your trading strategy using 15 minute timeframes, and if you’re unhappy with the results simply experiment with other timeframes. Deciding on the Type of Trade: Binary Options Trading Platforms allow for several trading types:

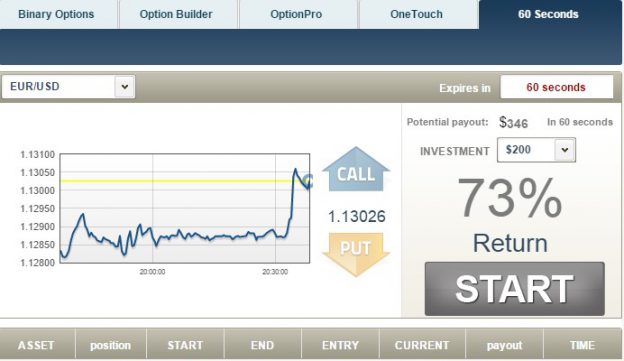

Above/Below Above and Below is the most popular type of binary options trade, most traders will use this type the majority of the time. Above/Below options expire in-the-money when the trader correctly predicts that the price of the underlying asset will move above or below the predetermined strike price by the time of expiration. Let’s look at a trading example: while looking at the assets available for trading you choose Gold as the asset you would like to trade. Following an analysis (that we will discuss later on) you come to the conclusion that Gold is currently trending up. Since you believe that the price of Gold will increase, you choose Call/up with an expiration time of 15 minutes and an amount of $100. You observe that the payout for this trade is 81%. If when the contract expires the price of Gold has risen, you’ll finish in the-money and take home the amount of $181. Here’s an example of an Above/Below trade:

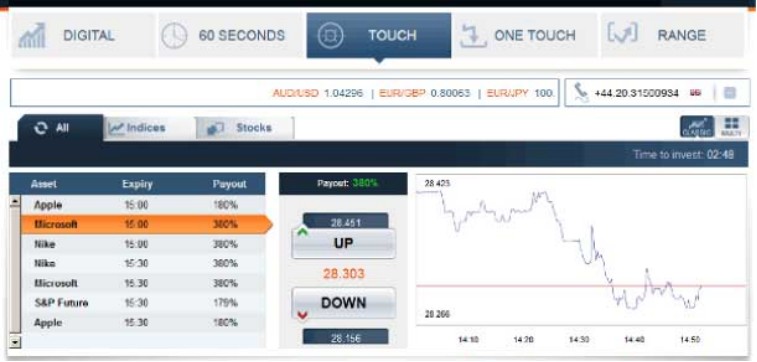

Touch With the Touch type options expire in-the-money if the price of the underlying asset touches a predetermined barrier by the time of expiration. Price barriers can be higher or lower than the current price of the underlying asset when the option is purchased. Binary Options brokers also offer variations on Touch, including “Touch Up” and “Touch Down”. Let’s look at a trading example: suppose you decide to trade a touch option on Google’s stock. You select Google as the asset you would like to trade and see that the option is expiring in 15 minutes with a return of 71%. Depending on the current price of the asset, two options are available with predetermined strike prices, “Touch Up” and “Touch Down”. You believe that the price of the underlying asset will touch the high strike price until the expiry date, so you select “Touch Up” and a trade amount of $100. On the other hand, if you believed that the price of Google would touch the low strike price, you would select “Touch Down”. If when the contract expires the price of Google has touched the option you selected, you’ll finish in-the-money and take home a payout of $171. Here’s an example of a touch trade:

Range Range options have a predetermined upper and lower boundary. When buying a range option, the trader have to predict whether the price of the underlying asset will stay “In” or go “Out” of a predetermined range at the time of expiration. In a range option you can trade on the volatility of the asset. If you think that the asset volatility is high, you will choose an “Out” of the range option. On the other hand, if you think that the option is not volatile, you will buy an “In” range option. Let’s look at a trading example: You decide to trade a Forex option, USD / EUR. You see that there are two options available, “In” and “Out”. Each option has a predetermined range and you must determine if the asset will be in the upper or lower range at the time of expiration. Based on your analysis you think that the price of the USD / EUR will be in the range at the time of expiration so you select the “In” option. If you thought that the price would be out of the range at the time of expiration, you should have bought an “Out” option. If when the contract expires the price of USD / EUR stayed in the predetermined range that you selected, you’ll get the predetermined payout amount. Additional Features: Some brokers will allow for some variations on the trading types. This may include: ‘Close Now’ and ‘Extend’. Note that both features require that you pay a flat fee upon implementing. Close Now – this feature allows you to sell your option before the time of expiration. This enables you to close an option before the time of expiration if it isn’t performing as planned. Extend (Roll Over) – allows you to extend the time of expiration in order to increase the odds of being in-the-money.