A Moving Average is a moving mean of data. In other words, Moving Averages perform a mathematical function where data within a selected period is averages and the average “moves’ as new data is included in the calculation while older data is removed or lessened. Moving averages essentially smooth data by removing ‘noise’. This smoothing of data makes Moving Averages popular tools in identifying price trends and trend reversals.

The differences between the three types of moving averages lie in the way that they are calculated and whether they look at all the data available or only the data within a selected period. This means that each type of moving average has its own characteristics, for example how quickly each will respond to changes in the underlying price.

Simple Moving Average

Simple Moving Averages are the most common and popular form of moving average. The primary reason for this is the relative ease with which Simple Moving Averages are calculated. A Simple Moving Average is calculated by adding values over a set number of periods and then dividing the sum by the total number of values.

As with other types of moving averages, Simple Moving Averages smooth the data by removing ‘noise’ over the selected period. The ability to smooth data makes them a useful tool in identifying price trends and trend reversals.

Moving average – Weighted

As with Simple Moving Averages, Weighted Moving Averages smooth the data by removing “noise’ over the selected period. However a weighted Moving Average will be more sensitive to recent changes in data. This is because a Simple Moving Average gives all observations equal emphasis in its calculation, but a Weighted Moving Average assigns a greater weight to the most recent observations.

Moving average – Exponential

The Exponential Moving Average is similar to the Weighted Moving Average in that they both assign greater weight to the most recent data. Where they differ is that instead of dropping off the oldest data point in the selected period of the moving average, the Exponential Moving Average continues to maintain tall the data. In other words, a 5 day Exponential Moving Average will contain more than 5 pieces of data information. Each observation becomes progressively less significant but still includes in its calculation all the price data in the life of the instrument. The exponential Moving Average is another method of weighting a moving average.

The most common uses of Moving Averages in Binary Options trading:

- Identify the trend

A common method involves looking at the slope of the Moving Average and the relationship of the prices to the Moving Average. For example, if the Moving Average is sloping down and prices are below the Moving Average then prices are considered to be in a downtrend. The opposite is true for an uptrend. If prices are moving above and below the Moving Average and the Moving Average is flat then a non-trending market exists.

- Give buy and sell signals

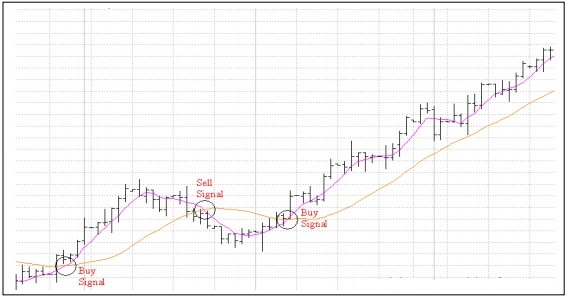

When trading binary options, this can be achieved a number of ways. The first method looks at the relationship between the close and a single Moving Average. If the market closes above the Moving Average then a buy signal is generated, if the market closes below the Moving Average then a sell signal is generated.

The second method uses two Moving Averages, one with a shorter observation period than the other. Buy and sell signals are generated when the short moving average crosses over the long moving average. For example if the short moving average crosses above the long moving average, a buy signal is generated; a sell signal is generated when the short Moving Average crosses below the long Moving average.

When trading binary options, both these buy and sell techniques is most effective when the market is trending. If the market is non-trending then these techniques are likely to give false signals. This is simply because the market needs to continue in the direction of the buy or sell signal in order for the trade to be profitable.

Exponential Moving averages are used in the same manner as the other types of moving average, usually to identify price trends and trend reversals.

Parameters

To use Moving averages in your binary options strategy, the exact averaging period to be used will depend on the purpose of the moving average. If you are using moving averages to identify the trend, the length of the averaging period should reflect the length of the trend you are trying to identify. The longer the trend – the longer the averaging period. For example, if you are looking at a daily chart to identify the long – term trend, you may decide to use an averaging period of 200. For short and medium term trends periods of 20 and 50 could be used respectively.

If you are using moving averages to generate buy and sell signals then shorter, more responsive averaging periods are normally used. For example a two moving average system may use averaging periods of 5 and 20.

It is also important to note that when selecting an averaging period there is a tradeoff between the averaging periods, the number of signals generated and the risk associated with the signal. A longer averaging period will generate fewer signals but will require a larger price move before responding, sacrificing potential profits in order to confirm the signal. A shorter averaging period will generate more signals and require less of a price move before responding, however the risk that the signal is false increases.