The Relative Strength Index isn’t just another squiggly line cluttering your charts. It’s a sophisticated momentum oscillator that reveals the hidden story behind price movements, helping you identify when currency pairs are primed for reversals or continuation moves. In a market where timing is everything and a few pips can determine profitability, mastering the RSI indicator can be the difference between consistently profitable trading and watching opportunities slip away.

For forex traders operating in today’s volatile currency markets, the RSI provides crucial insights into market psychology and momentum shifts that fundamental analysis alone cannot capture. Whether you’re scalping EUR/USD during the London session or swing trading exotic pairs, understanding how to interpret RSI signals will elevate your trading accuracy and help you make more informed decisions in real-time market conditions.

Understanding the Relative Strength Index: More Than Just Numbers

The Relative Strength Index, developed by J. Welles Wilder Jr. in 1978, measures the velocity and magnitude of price changes in any currency pair. Think of it as a speedometer for market momentum – while price tells you where a currency pair is going, RSI tells you how fast it’s getting there and whether that speed is sustainable.

Operating on a scale from 0 to 100, the RSI calculates the ratio of upward price movements to downward movements over a specified period, typically 14 trading sessions. When EUR/USD rallies aggressively, pushing RSI above 70, it suggests that buying pressure may be reaching unsustainable levels. Conversely, when the pair crashes and RSI drops below 30, it indicates that selling pressure might be nearing exhaustion.

What makes RSI particularly valuable for forex traders is its ability to function effectively across all major currency pairs and timeframes. Whether you’re analyzing USD/JPY on a 15-minute chart for scalping opportunities or studying AUD/USD on daily charts for swing trades, the RSI maintains its reliability in identifying momentum extremes and potential reversal points.

The indicator’s mathematical foundation removes emotional bias from momentum assessment, providing objective readings that help you avoid the psychological traps that plague many forex traders. When your gut tells you that GBP/JPY “feels overbought,” the RSI gives you quantifiable evidence to either support or challenge that intuition, leading to more disciplined trading decisions.

The Mathematical Foundation: How RSI Calculates Momentum

Understanding RSI’s calculation methodology doesn’t require advanced mathematics, but grasping the basics will make you a more effective trader. The indicator compares the average magnitude of gains during up periods to the average magnitude of losses during down periods over the chosen timeframe, creating a relative strength measurement that oscillates between defined boundaries.

Here’s how it works in practical forex terms: Imagine you’re tracking USD/CAD over 14 trading days. The RSI examines each day where the pair closed higher than the previous day, calculating the average size of those gains. Simultaneously, it analyzes days where the pair closed lower, determining the average magnitude of those losses. The RSI then creates a ratio between these averages and converts it to the familiar 0-100 scale.

This calculation method ensures that RSI readings remain comparable across different currency pairs and market conditions. A reading of 75 on EUR/GBP carries the same momentum implications as a 75 reading on NZD/USD, despite the pairs having different volatility characteristics and pip values. This consistency makes RSI an invaluable tool for traders who monitor multiple currency pairs simultaneously.

The standard 14-period setting represents Wilder’s optimal balance between sensitivity and reliability. Shorter periods like 9 make RSI more responsive to recent price changes but increase the likelihood of false signals, particularly during choppy market conditions. Longer periods such as 21 create smoother readings but may delay signal generation, potentially causing you to miss optimal entry points in fast-moving forex markets.

Interpreting RSI Levels: The Three Critical Zones

Successful RSI trading begins with understanding the significance of different reading levels and what they reveal about market sentiment. The traditional interpretation divides the indicator into three distinct zones, each offering unique insights for forex traders seeking profitable opportunities.

The overbought zone above 70 represents conditions where buying enthusiasm may have reached unsustainable levels. When your favorite currency pair pushes RSI above 70, it doesn’t automatically trigger a sell signal, but it does warn that the current rally may be losing momentum. Smart forex traders use these readings as early warning systems, preparing for potential consolidation periods or trend reversals while managing existing long positions more carefully.

The oversold zone below 30 indicates conditions where selling pressure may be approaching exhaustion. RSI readings in this territory often precede bounces or reversals, as weak hands finish selling and value buyers begin accumulating positions. However, remember that strong downtrends can keep RSI oversold for extended periods, making patience and additional confirmation crucial for successful bottom-fishing strategies.

The neutral zone between 30 and 70 represents balanced market conditions where neither buyers nor sellers have established clear dominance. Many profitable trading opportunities emerge when RSI transitions from extreme levels back into this neutral territory, signaling shifts in momentum dynamics that often precede significant price movements in major currency pairs.

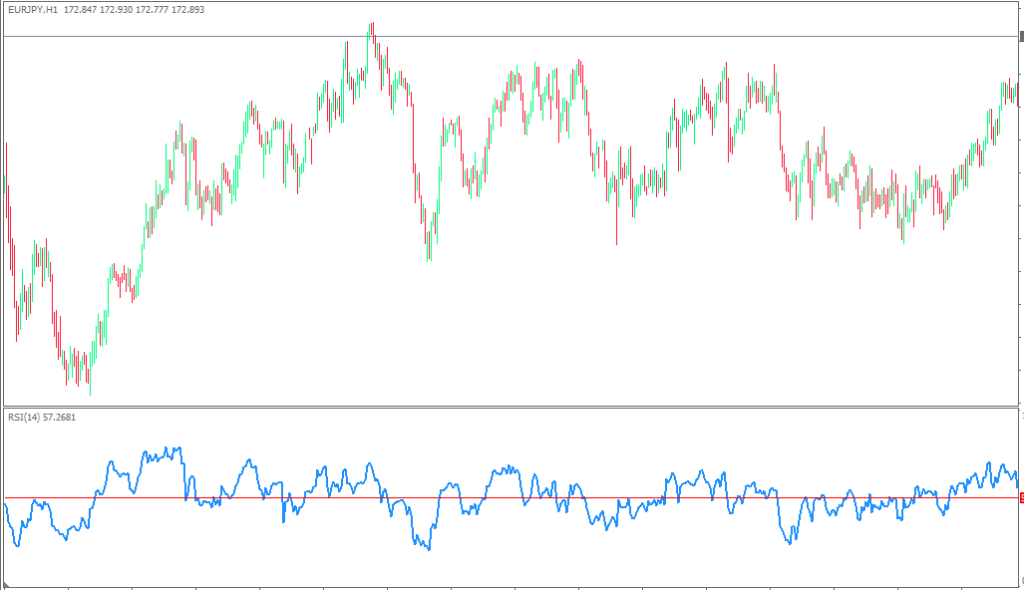

Understanding these zones becomes particularly powerful when combined with divergence analysis. When GBP/USD makes higher highs while RSI creates lower highs, this bearish divergence warns that upward momentum is weakening despite rising prices. Conversely, when price makes lower lows while RSI forms higher lows, the resulting bullish divergence suggests that selling pressure is diminishing and a reversal may be imminent.

Advanced RSI Trading Strategies for Forex Markets

Implementing RSI effectively in forex trading requires moving beyond basic overbought and oversold interpretations to develop sophisticated strategies that account for market context and confirmation signals. The most successful forex traders use RSI as part of comprehensive trading systems rather than relying on isolated signals.

Divergence trading represents one of the most powerful RSI applications in forex markets. This strategy involves identifying situations where price action and RSI momentum move in opposite directions, creating high-probability reversal setups. For example, when AUD/USD establishes a series of higher highs while RSI creates lower highs, this bearish divergence often precedes significant downward moves, especially when it occurs near major resistance levels or following extended rallies.

The RSI centerline strategy focuses on the 50 level as a momentum watershed for trend-following opportunities. In established uptrends, RSI tends to maintain readings above 50, with pullbacks to this level often providing excellent buying opportunities. When USD/CHF is in a strong uptrend and RSI dips to 50 before bouncing higher, it typically signals trend continuation rather than reversal, offering favorable risk-reward entries for trend-following traders.

Multiple timeframe analysis enhances RSI effectiveness by providing both context and precision timing. Checking daily RSI for overall momentum bias while using hourly RSI for specific entry timing can significantly improve trade accuracy. When daily RSI shows oversold conditions on EUR/JPY while hourly RSI displays bullish divergence, the confluence creates compelling long setups with clearly defined risk parameters.

Combining RSI with key technical levels maximizes signal reliability in forex trading. RSI overbought readings that coincide with major resistance levels carry much more weight than similar readings in the middle of trading ranges. Similarly, RSI oversold conditions near significant support zones often produce more reliable bounce opportunities than those occurring without clear technical backing.

Avoiding Common RSI Trading Pitfalls

Even experienced forex traders make predictable mistakes when applying RSI analysis to their trading strategies. Understanding these common pitfalls can save you significant capital and improve your long-term trading performance across all currency pairs.

The most costly mistake involves treating RSI signals as absolute trading commands rather than probability-based insights. When RSI reaches 80 on USD/JPY, it indicates strong momentum but doesn’t guarantee an immediate reversal. Markets can trend much further than most traders anticipate, and premature counter-trend positions based solely on extreme RSI readings often result in substantial losses during persistent trending periods.

Context ignorance represents another frequent error that undermines RSI effectiveness. An RSI reading of 25 might appear bullish in isolation, but if it occurs during a strong downtrend in GBP/CAD with negative fundamental developments, the signal carries significantly less weight than the same reading during an established uptrend with supportive economic conditions.

Overreliance on RSI without considering broader market structure leads to poor trading decisions and missed opportunities. Successful forex trading requires multiple confluence factors working together, and RSI performs best when integrated with support and resistance analysis, trend identification, and proper risk management protocols rather than being used as a standalone decision-making tool.

Many traders also fall into the overtrading trap, attempting to act on every RSI signal regardless of quality or market conditions. The indicator can generate numerous signals throughout active trading sessions, but quality trumps quantity in profitable forex trading. Waiting for high-probability RSI setups that align with key technical levels and favorable risk-reward ratios typically produces better results than chasing every oversold or overbought reading.

RSI Performance Across Different Market Conditions

Understanding how RSI behaves in various market environments is crucial for adapting your trading strategy to current conditions and maximizing the indicator’s effectiveness across different currency pairs and timeframes.

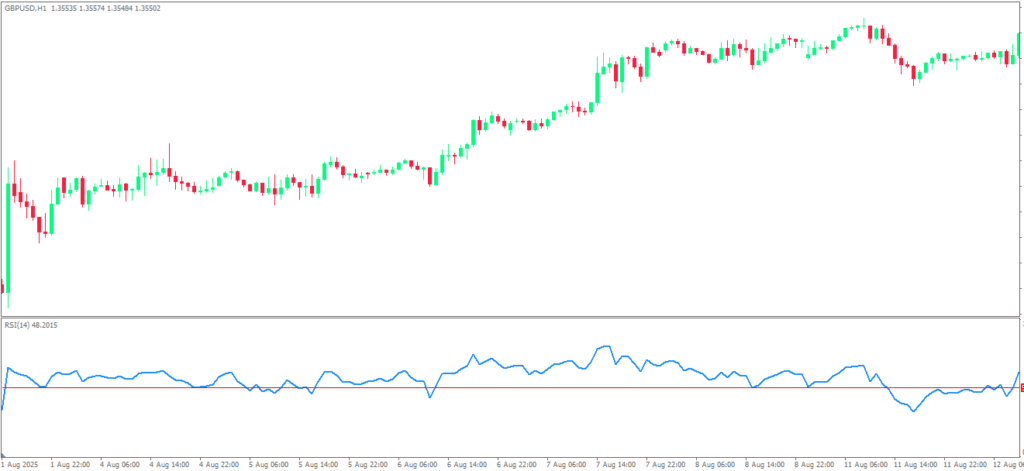

During trending markets, RSI readings can remain at extreme levels for extended periods, challenging traditional overbought and oversold interpretations. When EUR/USD enters a strong uptrend driven by fundamental factors like interest rate differentials, RSI may stay above 70 for weeks while the pair continues climbing. In these conditions, focus shifts from reversal signals to trend continuation opportunities, using RSI pullbacks to the 50 level as potential buying opportunities rather than seeking counter-trend trades.

Range-bound markets provide ideal conditions for classic RSI trading strategies, as oscillations between defined support and resistance levels create predictable momentum cycles. During these periods, traditional overbought and oversold signals often prove more reliable, with RSI readings above 70 frequently leading to pullbacks toward range lows and readings below 30 often preceding bounces toward range highs.

Volatile market conditions, such as those following major economic announcements or geopolitical events, can cause RSI to whipsaw between extreme readings rapidly. These periods require increased caution and additional confirmation signals, as the indicator may generate false signals more frequently when market sentiment shifts quickly and unpredictably.

News-driven markets present unique challenges for RSI interpretation, as fundamental catalysts can override technical momentum signals. When central bank decisions or economic data releases drive currency movements, RSI readings may become temporarily less reliable as market participants react to new information rather than technical levels and momentum patterns.

Integrating RSI with Other Technical Indicators

While RSI provides valuable momentum insights, combining it with complementary indicators creates more robust trading systems and improves signal reliability across various market conditions and currency pairs.

Moving averages work exceptionally well with RSI analysis by providing trend context for momentum signals. When USD/CAD trades above its 200-day moving average and RSI shows bullish divergence near oversold levels, the combination creates compelling long setups with clearly defined trend direction and momentum confirmation. Conversely, RSI overbought readings below major moving averages often provide high-probability short opportunities.

Support and resistance levels significantly enhance RSI signal quality by providing logical entry and exit points for momentum-based trades. An RSI oversold reading that occurs near a well-tested support level on GBP/AUD carries much more significance than similar readings in the middle of trading ranges, as the technical level provides additional confirmation of potential buying interest.

Volume analysis, while less commonly used in forex due to decentralized market structure, can still provide valuable confirmation for RSI signals when available. Increasing volume accompanying RSI divergences often indicates stronger conviction behind the momentum shift, improving the probability of successful reversal trades.

Candlestick patterns complement RSI analysis by providing precise timing and confirmation for momentum signals. When RSI shows bullish divergence on NZD/USD and coincides with a hammer or doji formation near support, the combination creates high-probability reversal setups with clearly defined risk parameters and profit targets.

Optimizing RSI Settings for Forex Trading

While the standard 14-period RSI setting works well for most applications, understanding when and how to adjust these parameters can improve the indicator’s performance for specific trading styles and market conditions.

Shorter RSI periods like 9 or 11 create more sensitive readings that respond quickly to price changes, making them suitable for scalping strategies and short-term trading approaches. However, increased sensitivity comes with higher false signal rates, requiring additional confirmation methods and stricter risk management protocols to maintain profitability.

Longer RSI periods such as 21 or 25 produce smoother readings that filter out market noise but may delay signal generation. These settings work well for swing trading strategies and longer-term position trades, where signal quality matters more than immediate responsiveness to short-term price fluctuations.

Adjusting overbought and oversold levels can improve RSI performance for specific currency pairs or market conditions. Some traders find that using 80 and 20 instead of the traditional 70 and 30 levels reduces false signals in trending markets while maintaining adequate sensitivity for reversal identification.

The RSI period should align with your trading timeframe and holding period preferences. Day traders operating on 15-minute charts might benefit from shorter RSI periods, while position traders using daily charts may prefer longer periods that filter out intraday noise and focus on significant momentum shifts.

Real-World RSI Trading Examples and Case Studies

Examining specific RSI trading scenarios helps illustrate practical application principles and demonstrates how successful traders integrate momentum analysis into their decision-making processes across different market conditions.

Consider a recent EUR/USD trading opportunity where the pair rallied from 1.0800 to 1.1200 over several weeks, pushing RSI above 75. While many traders anticipated an immediate reversal based on overbought conditions, experienced RSI traders recognized that strong uptrends can maintain overbought readings for extended periods. Instead of counter-trend trades, they waited for RSI to pull back toward 50 while price consolidated, then entered long positions on the continuation move that carried EUR/USD to 1.1400.

A GBP/JPY divergence example demonstrates RSI’s power for reversal identification. As the pair made successive higher highs near 165.00, RSI created lower highs, forming clear bearish divergence. This momentum weakening preceded a sharp 400-pip decline that rewarded patient traders who recognized the signal and positioned accordingly with appropriate risk management.

During a ranging period in AUD/USD between 0.6500 and 0.7000, RSI provided excellent signals for range trading. Overbought readings above 70 near 0.6950 resistance consistently led to profitable short trades toward range support, while oversold readings below 30 near 0.6550 support generated successful long opportunities toward range highs.

These examples highlight the importance of market context when interpreting RSI signals and demonstrate why successful traders combine momentum analysis with broader technical and fundamental considerations rather than relying on isolated indicator readings.

Advanced RSI Techniques for Professional Traders

Professional forex traders employ sophisticated RSI techniques that go beyond basic overbought and oversold interpretations, developing nuanced approaches that account for market microstructure and institutional behavior patterns.

Multiple timeframe divergence analysis involves checking for momentum divergences across different chart timeframes simultaneously. When daily RSI shows bearish divergence on USD/CHF while 4-hour RSI confirms the pattern, the confluence creates high-conviction trading opportunities with favorable risk-reward profiles and clearly defined technical levels for risk management.

RSI trend line analysis applies traditional trend line concepts to momentum readings rather than price action. Drawing trend lines on RSI peaks and troughs can reveal momentum pattern breaks that precede significant price movements, often providing earlier signals than price-based trend line analysis alone.

Hidden divergence patterns occur when RSI makes higher lows while price creates lower lows during uptrends, suggesting trend continuation rather than reversal. These patterns help identify pullback completion and trend resumption opportunities in strongly trending currency pairs.

Failure swing patterns involve RSI failing to reach previous extreme levels during subsequent price moves, indicating momentum weakening even when price achieves new highs or lows. These subtle momentum failures often precede significant reversals in major currency pairs.

Risk Management with RSI Trading Strategies

Effective risk management remains crucial when implementing RSI-based trading strategies, as momentum indicators can generate false signals that lead to substantial losses without proper protective measures and position sizing protocols.

Stop loss placement with RSI trades should prioritize price-based levels over indicator readings. While RSI may suggest oversold conditions on EUR/GBP, place stops below recent swing lows or key support levels rather than relying on RSI returning to neutral territory, as momentum can remain extreme longer than account balances can withstand adverse moves.

Position sizing should reflect RSI signal quality and market conditions. High-conviction setups featuring multiple timeframe confirmation and key technical level confluence justify larger position sizes, while isolated RSI signals in choppy markets warrant reduced exposure to account for higher uncertainty and false signal probability.

Profit taking strategies benefit from RSI guidance, as momentum extremes often coincide with optimal exit opportunities. When long positions on USD/JPY show profits and RSI reaches overbought levels near resistance, partial profit taking protects gains while maintaining exposure for potential continuation moves.

Portfolio correlation considerations become important when multiple RSI signals occur simultaneously across related currency pairs. Taking large positions in EUR/USD, GBP/USD, and EUR/GBP based on similar RSI setups creates concentration risk, as these correlated pairs may move together and amplify losses if the analysis proves incorrect.

The Future of RSI Analysis in Modern Forex Trading

As forex markets evolve with technological advancement and changing participant dynamics, RSI analysis continues adapting to remain relevant for contemporary traders using modern platforms and analytical tools.

Algorithmic trading integration increasingly incorporates RSI parameters into systematic trading strategies, creating new market dynamics where traditional RSI levels may shift as automated systems react to momentum extremes more quickly than human traders historically managed.

Artificial intelligence and machine learning applications are beginning to enhance RSI analysis by identifying subtle pattern recognition opportunities and optimizing parameter settings based on historical performance data and current market conditions across multiple currency pairs simultaneously.

Real-time news sentiment integration with RSI analysis helps modern traders understand when fundamental developments may override technical momentum signals, improving decision-making accuracy during high-impact news events and central bank communications.

Mobile trading platforms now provide sophisticated RSI analysis tools that allow traders to monitor momentum developments and receive alerts across multiple currency pairs and timeframes, enabling more responsive trade management and opportunity identification regardless of physical location.

Mastering RSI: Your Path to Consistent Forex Profits

The Relative Strength Index represents far more than a simple overbought/oversold indicator – it’s a sophisticated momentum analysis tool that reveals market psychology and helps identify high-probability trading opportunities across all major currency pairs and timeframes. Success with RSI requires moving beyond basic interpretations to develop nuanced understanding of how momentum behaves under different market conditions.

Remember that RSI works best as part of comprehensive trading strategies that incorporate multiple forms of analysis rather than standalone signal generation. The most profitable forex traders use RSI to confirm their fundamental analysis, time their technical setups, and manage their existing positions with greater precision and confidence.

Market conditions will continue evolving, but the underlying momentum patterns that RSI captures have remained remarkably consistent throughout decades of currency trading. Developing expertise with this indicator provides you with reliable tools for navigating volatile forex markets and identifying profitable opportunities that less experienced traders often miss.

Start implementing RSI analysis gradually in your current trading approach, beginning with longer timeframes and high-conviction setups before expanding to shorter-term applications. Practice with demo accounts or small position sizes until you develop intuitive understanding of how RSI behaves with your preferred currency pairs and trading style.

The journey to RSI mastery requires patience and consistent practice, but the rewards include improved timing, better risk management, and increased confidence in your trading decisions. Take the first step today by adding RSI to your charts and beginning the process of developing this crucial skill that can transform your forex trading results.

Ready to revolutionize your forex trading with professional RSI analysis? Share your RSI experiences and questions in the comments below, subscribe to our newsletter for exclusive advanced trading strategies, and explore our comprehensive technical analysis course designed specifically for serious forex traders seeking consistent profitability.

Frequently Asked Questions

What is the most effective RSI setting for forex day trading?

The standard 14-period RSI setting works effectively for most forex day trading applications, providing optimal balance between signal responsiveness and reliability. Some day traders prefer shorter periods like 9 or 11 for increased sensitivity to intraday price movements, but these settings generate more false signals requiring additional confirmation methods. Stick with 14 periods initially and adjust based on your specific currency pairs and trading timeframes after gaining experience.

How do I distinguish between valid RSI signals and false signals in forex trading?

Valid RSI signals typically occur near key technical levels like support/resistance zones, coincide with divergence patterns, and align with broader market trends and fundamental analysis. False signals often appear in isolation without supporting technical evidence or during strong trending periods where momentum can remain extreme for extended durations. Always seek confluence between RSI readings, price action, and other technical factors before making trading decisions.

Can RSI be used effectively for scalping major currency pairs?

Yes, RSI can enhance scalping strategies when applied to shorter timeframes like 1-minute or 5-minute charts of major pairs like EUR/USD, GBP/USD, and USD/JPY. Focus on RSI divergences near intraday support/resistance levels and extreme readings that coincide with price action confirmation. However, scalping with RSI requires strict risk management due to increased false signal frequency on shorter timeframes.

What’s the difference between regular and hidden RSI divergence patterns?

Regular divergence occurs when price and RSI move in opposite directions, typically signaling potential trend reversal. Hidden divergence happens when RSI makes higher lows while price creates lower lows in uptrends (or lower highs while price makes higher highs in downtrends), suggesting trend continuation rather than reversal. Hidden divergence helps identify pullback completion and trend resumption opportunities in strongly trending currency pairs.

How should I combine RSI with other indicators for better forex trading results?

Effective RSI combinations include pairing it with moving averages for trend context, support/resistance levels for entry/exit precision, and candlestick patterns for timing confirmation. For example, RSI oversold readings near 200-day moving average support with bullish candlestick patterns create high-probability long setups. Avoid using too many indicators simultaneously, as this can lead to analysis paralysis and conflicting signals that complicate decision-making.