Consider the following advantages and disadvantages when trading Binary Options:

Advantages

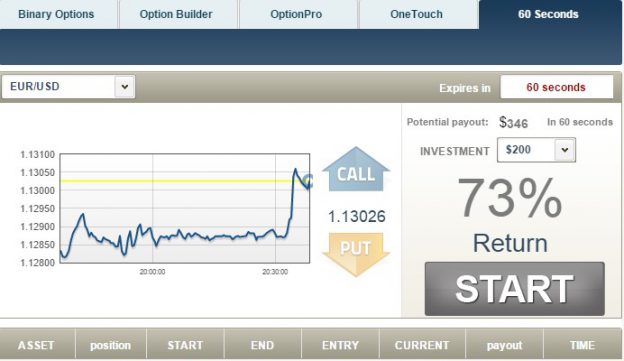

Risk control – With binary options the return on initial investment is fixed from the beginning, thus the amount of possible profit or loss is well known. Meaning you’ll never lose more than what you expected and can determine your risk as completely as possible. There’s a limit on how much could be earned or lost in one trade. Because the rate of return is relatively high, and trade times are short, in the long run the fixed rate of a binary option can be a big advantage. Short-time trading (daily, hourly) – with binary options you decide what the expiry time of the option will be. If you are a fan of long-time investments, you can choose “end of the week” and “end of the month” expiry times. However, most traders would prefer shorter time frames. Low minimum amounts – Binary brokers have low investment minimums, thus allowing you to start with small amounts. With most brokers you can start trading with as low as $20. If you are familiar with stock market trading, you probably know that you need a decent amount of preliminary investment capital, brokers, commissions, etc. Thus the possibility to begin trading with just $20 as well as the flexibility to pick your investment amount is certainly an advantage. Online trading – binary options are traded on online platforms and therefore you don’t need any software downloads. Trading is available anywhere, all you need is a computer and internet access. You simply enter your login and password and get straight to your personal profile page and start trading. Simplicity – Trading Binary options is very simple and straight forward, all you need to do is decide which of the two directions the asset will move, up or down.

Disadvantages of Binary Options

The main disadvantage of trading binary options is the level of “fee” that is paid to the broker; it is relatively higher than in other investment areas. Fee? What fee? Well, it’s not exactly a fee; it’s more of a ‘spread’. The brokers’ “fee” is embedded in the business model of a binary options brokerage. You buy the options contracts from the broker, if you win, the broker will pay you out about 71% to 85%. If the contract expires “out of the money”, some brokers will refund a small percentage of the principal. The broker gets the difference between the sum that they keep on a losing trade and the amount they pay out on a winning trade.